Partnership Firm Registration

Partnership Firm Registration is the process of formally registering a business partnership with the Registrar of Firms in the respective state. While it is optional under Indian law, a registered partnership firm enjoys added legal benefits, credibility, and access to government schemes.

- A Partnership firm registration deed that was entirely completed online and without difficulty in three days.

- Transparent process through follow-up and regular updates

Over 85,000+ Partnership Deeds Have Been Filed Since 2011.

Our Services

All Inclusive Service-Inclusive of Government Fees

- PAN Registration

- TAN Registration

- Includes ESI & PF Registration

- Inclusive of GST Registration

- Free 6 month of TDS Return Filing

- Also includes Share Certificate

- Free Consultancy from Chartered Accountatnt for 6 months

What is a Partnership Firm?

A partnership firm is a business structure where two or more individuals come together to operate a business with the goal of making a profit. The partners agree to share the responsibilities, profits, and losses of the business according to the terms set out in a legal agreement called the partnership deed. Each partner is jointly and severally liable for the actions of the firm and other partners. This business model is particularly popular among small and medium-sized businesses because it’s easier to set up and manage compared to a company.

In India, partnership firms are governed by the Indian Partnership Act, 1932, which lays down the legal framework for the functioning of these firms. The Act defines key terms, outlines the responsibilities and rights of partners, and provides guidelines for the formation, dissolution, and management of partnership firms.

18th and 19th Century: The Evolution of Legal Framework

As trade expanded during the Industrial Revolution in the 18th and 19th centuries, partnerships became more common, especially in Europe and the United States. With the rise of industrialization, partnerships were seen as an effective way for small and medium-sized businesses to operate without the formalities of corporations.

In England, the legal structure of partnerships started to take shape during the 19th century, and many countries followed similar frameworks. The English Partnership Act of 1890 provided a legal foundation that recognized partnerships as distinct entities from their owners, though the concept of unlimited liability (where each partner is personally responsible for the firm’s debts) was still a key feature.

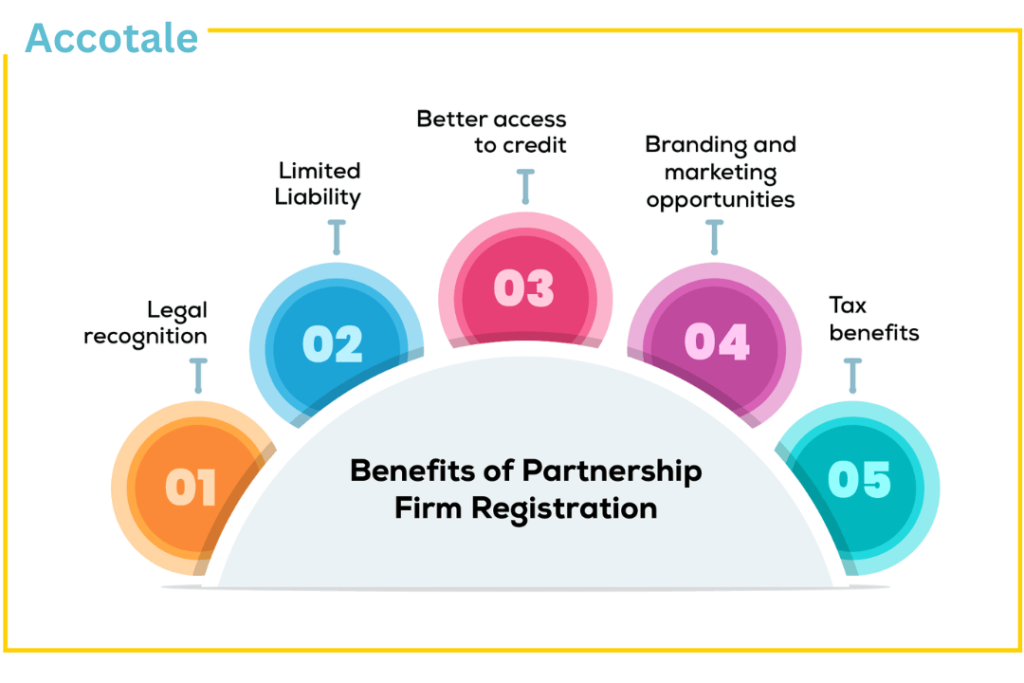

Advantages of Partnership Firm Registration Online

Quick and Easy Process

Registering a partnership firm online streamlines the entire process, allowing you to complete formalities without having to visit government offices. The online process simplifies documentation and speeds up approvals, helping you start your business faster.

Cost-Effective Registration

Online registration is typically more cost-effective than the traditional method. With fewer physical requirements and streamlined procedures, online services reduce overheads like travel and paperwork expenses.

To successfully register a partnership firm, certain essential documents must be submitted. These documents help in verifying the identity of the partners and the business, ensuring compliance with legal requirements.

Minimum Compliance:-Unless you employ someone to manage this for you, something else always comes in the way when a private limited business is involved. When you establish a partnership, you get rid of this difficulty. Sincerely, you don’t want the initial stages of your company to be hampered by regulatory tasks. All you want to do is focus on your business.

Documents Required

A typical company structure that permits two or more people to work together and share duties is the registration of a partnership firm in India. For a smooth and compliant operation, it is crucial to finish the required paperwork and legal formalities. The following documents are needed in order to register a partnership firm.

- Partnership Deed

- Address Proof

- Identity Proof of Partners

- Bank Account Proof

- Power of Attorney

- Partnership Firm's PAN Card

- Passport-sized Photographs

- Address Proof of Partners

- Registration Certificate (if applicable)

- Specimen Signature

- GST Registration (if applicable)

- NOC from the Property Owner

Eligibility for Partnership Firm Registration Online

Before proceeding with the online registration of your partnership firm, it’s important to ensure that you meet the eligibility requirements. at accotale, we guide you through the process, helping you confirm that your partnership firm meets all legal criteria for registration under the Indian Partnership Act, 1932.

Eligibility Criteria for Partnership Firm Registration:–

Minimum of Two Partners:

A partnership firm must have at least two partners to form the business. These partners can be individuals or entities (such as companies or LLPs). There is no maximum limit on the number of partners as per the Indian Partnership Act.Mutual Agreement Between Partners:

All partners must agree to share the profits and losses of the business in a pre-determined ratio as outlined in the partnership deed. This mutual consent is crucial for the registration process.Indian Resident Partners:

All partners in the firm must be residents of India. Foreign nationals are not allowed to form a partnership firm in India without prior government approval.Legally Sound Partnership Deed:

A well-drafted partnership deed is a mandatory requirement for registration. It must clearly outline the roles, responsibilities, profit-sharing ratio, and terms of the partnership agreement. This document serves as the foundation for the partnership firm.Business Purpose:

The partnership firm must be formed for a lawful business purpose. Any illegal business activities will render the firm ineligible for registration.Unique Business Name:

The name of the partnership firm should be unique and not similar to any existing firm or brand name. It should also not contain words that are prohibited under the Emblems and Names (Prevention of Improper Use) Act, 1950.Principal Place of Business:

The firm must have a principal place of business, which will be registered as the official address of the firm. This can be a rented or owned premises.

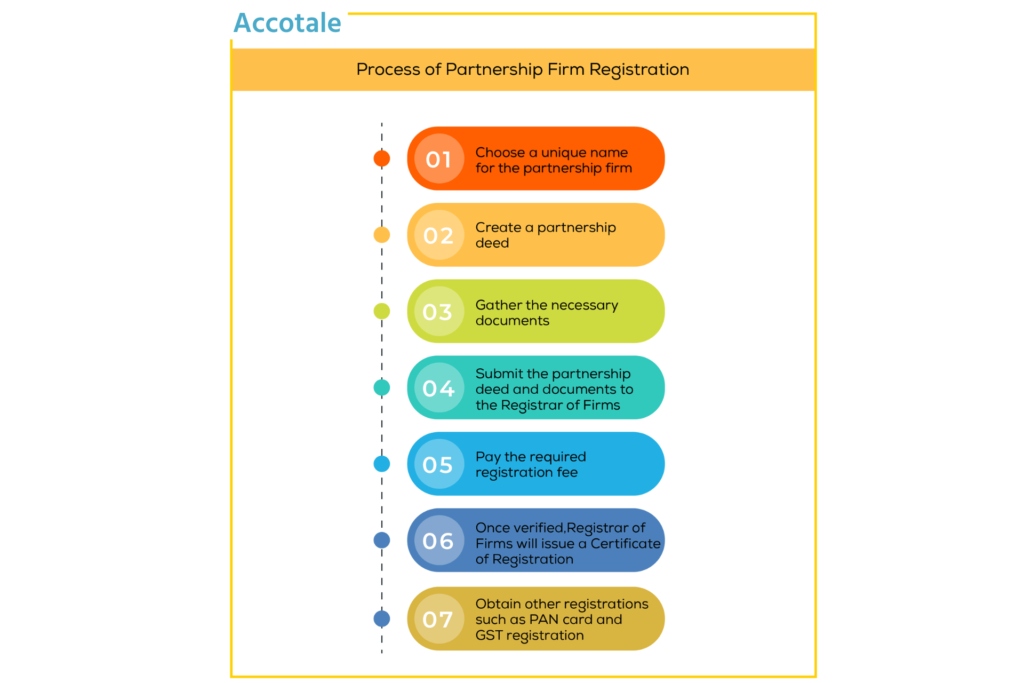

Steps for Partnership Firm Registration Online

Step 1: Submit a Register Partnership Firm Application

An application together with the necessary fees must be sent to the Registrar of Firms in the state where the business is situated. The registration application needs to be signed and verified by each partner or by their agent.

Step 2: Choosing the Name of the Partnership Firm

You can call a partnership firm registration by any name. Make sure they follow the guidelines, though, such as not using the same name again and avoiding anything pertaining to the government, among others.

Step 3: Registration Certificate

If the Registrar is satisfied with the registration application and supporting documents, the firm will be entered into the Register of Firms and issued the Registration Certificate. The most current information about all firms is accessible to the public for a fee in the Register of Firms.

Characteristics of Partnership Firm

1. Two or More Partners

A partnership firm is formed by at least two individuals who agree to run a business together. The maximum number of partners can vary based on the type of business but typically does not exceed 20 partners.

2. Agreement or Deed

A partnership firm is established through a mutual agreement between partners, which can be verbal or written. A written agreement, known as the Partnership Deed, outlines the roles, responsibilities, profit-sharing ratio, and other operational terms, ensuring clarity and minimizing disputes.

3. Profit Sharing

Partners share the profits (and losses) of the business according to the ratio agreed upon in the partnership deed. This profit-sharing ratio can vary between partners based on their investment or role in the firm.

4. Joint Management

The firm is typically managed jointly by all partners. However, the deed can specify that one or more partners take on a more active role in the business, while others may contribute capital or expertise.

5. Unlimited Liability

In a partnership firm, partners have unlimited liability, meaning that in case of debts or liabilities, their personal assets can be used to settle the firm’s obligations. Each partner is responsible for the firm’s debts, not just to the extent of their investment but beyond that as well.

6. Mutual Agency

Each partner acts as an agent for the firm and can bind the firm through their actions. This means that decisions made by one partner can impact the entire firm and all other partners.

7. Limited Legal Existence

A partnership firm does not have a separate legal identity from its partners, unlike a corporation. The firm is closely linked to the partners, and in case of the death, bankruptcy, or incapacity of a partner, the firm may dissolve unless specified otherwise in the deed.

8. Non-Transferable Interest

Partners cannot transfer their interest in the firm to a third party without the consent of all other partners. This ensures that control of the firm remains within the agreed partnership.

9. Flexibility in Decision-Making

Partnerships are generally flexible in decision-making, with partners having the autonomy to decide on business matters without needing formal resolutions or approvals, as is often required in corporations.

10. Limited Duration

A partnership firm typically exists as long as the partners agree to continue the business. It may be dissolved upon mutual agreement, the death of a partner, or other specific conditions mentioned in the partnership deed.

Partnership Deed Format

A partnership deed format summarizes the legal alternatives available to the partners in the firm. It ought to include:

In the event of a disagreement between the partners, the partnership deed will be easily referred to, simplifying the resolution process.

It is very helpful in avoiding misunderstandings between the partners that the deed covers all of the conditions and circumstances of the partnerships.

It governs the duties, privileges, and liabilities of each partner.

The partners' misconception about how to divide losses and get paid back for profits

Duties of Partners in Partnership Registration

Here’s a detailed explanation of the Duties of Partners in a Partnership Firm under the Partnership Act, 1932:

In a partnership firm, the roles and responsibilities of each partner play a crucial role in the successful functioning of the business. The Indian Partnership Act, 1932, outlines certain duties that partners must adhere to, ensuring the smooth operation of the firm and protecting the rights of all partners. These duties foster mutual trust and accountability among partners, contributing to a harmonious business relationship.

Duty of Good Faith and Honesty:

Every partner in the firm is bound by the duty of utmost good faith, honesty, and fairness. Partners are expected to act in the best interest of the firm and not engage in any activity that could harm the firm or other partners. They should disclose any personal interests or potential conflicts that may affect the business.Duty to Work Diligently for the Firm:

Partners have a responsibility to actively participate in the business operations and work diligently to contribute to the firm’s success. This includes attending meetings, being involved in decision-making processes, and performing tasks as assigned in the partnership deed or mutually agreed upon.Duty to Share Profits and Losses:

As per the partnership agreement, partners must share both profits and losses of the business in the agreed ratio. If the partnership deed does not specify a profit-sharing ratio, partners are expected to share profits and losses equally, as per the Partnership Act.Duty to Indemnify for Fraud or Willful Neglect:

If a partner commits any fraudulent act or engages in willful neglect or misconduct that causes harm or financial loss to the firm, they are responsible for compensating the firm and other partners for the damages incurred.Duty to Act Within Authority:

Partners must act within the scope of their authority as outlined in the partnership deed. They should not take actions that are beyond their designated role or without the consent of other partners. Any significant decision or contract made outside the partner’s authority can be deemed invalid, and the partner may be held accountable.Duty to Maintain and Render Accounts:

Every partner is required to maintain accurate records of the firm’s financial transactions and business dealings. Partners must be transparent and provide complete and accurate information when rendering accounts to the other partners. This ensures accountability and avoids disputes over financial matters.Duty to Avoid Competing with the Firm:

Partners are expected not to engage in any business activity that competes with the firm or harms its interests. If a partner starts or engages in a competing business, they must account for and surrender any profits earned from that activity to the firm.Duty of Confidentiality:

Partners must maintain confidentiality regarding sensitive information related to the firm’s business, clients, or strategies. Sharing confidential information without the consent of the firm can lead to legal liabilities.Duty to Contribute to the Firm’s Liabilities:

In a partnership, partners have unlimited liability, meaning they are personally liable for the debts and obligations of the firm. Partners are expected to contribute to the firm’s liabilities in the agreed ratio. If one partner pays more than their share, they have the right to claim compensation from the other partners.

Partnership Deed Online Registration Fees

We offer affordable and transparent pricing for registering your partnership deed online. We understand that starting a business comes with various expenses, and our goal is to provide cost-effective solutions without compromising on quality or compliance. Our fees cover everything from drafting the partnership deed to filing the necessary documents with the Registrar of Firms, ensuring a hassle-free registration process.

-

PAN Registration

-

TAN Registration

-

Includes ESI & PF Registration

-

Inclusive of GST Registration

-

Inclusive of Class 3 Digital Signature with USB

-

Free 6 month of TDS Return Filing

-

Free Consultancy from Chartered Accountatnt for 6 months

Distinction Between Partnership and Firm

| Partnership | Firm |

|---|---|

| Business owned by two or more persons | Business owned by an individual or group |

| Owners are called partners | Owners are called proprietors |

| Partners share profits and losses | Proprietors bear profits and losses |

| Partners are personally liable | Proprietors are personally liable |

| A partnership deed is necessary | No separate deed is required |

| Registration is optional | Registration is mandatory |

| Dissolution is by mutual agreement | Dissolution can be voluntary or compulsory |

Partnerships Vs. Company

| Criteria | Partnership | Company |

|---|---|---|

| Legal Status | Unincorporated | Incorporated |

| Number of Owners | Two or more | One or more |

| Liability | Unlimited liability for partners | Limited liability for shareholders |

| Management | Managed by partners | Managed by directors appointed by shareholders |

| Ownership | Joint ownership by partners | Individual ownership of shares by shareholders |

| Raising Capital | Limited options | Can issue shares and raise capital from public |

| Legal Compliance | Less formalities governed by Partnership Act, 1932 | More formalities, governed by Companies Act, 2013 |

| Taxation | Partners pay tax on share of partnership income | Company taxed as separate legal entity, shareholders taxed on dividends |

| Continuity | Dissolves on death or resignation of a partner | Continuity of existence |

| Transferability of Ownership | No transferability of ownership without consent of partners | Shares can be bought and sold freely |

| Reporting | No mandatory reporting requirements | Must maintain books and file annual returns and financial statements |

Partnership Vs. Club

| Criteria | Partnership | Club |

|---|---|---|

| Legal Structure | Unincorporated | Unincorporated |

| Formation | Requires an agreement between two or more persons | Formed by individuals with a common interest |

| Members | Called partners, who jointly own and manage the business | Called members, who are part of a group with a common interest |

| Liability | Partners have unlimited liability for the firm’s debts and obligations | Members have limited liability, typically up to the amount of their contribution |

| Management | Partners manage the business jointly | Club is typically run by a board of directors or an elected group of officers |

| Taxation | Partnerships are pass-through entities, with the profits and losses flowing through to partners’ personal tax returns | Clubs may be taxed as nonprofit organisations, and may be exempt from federal income tax |

| Ownership | Partners jointly own the assets and liabilities of the business | Clubs may be owned by a nonprofit organisation or by the members collectively |

Partnership Vs. Hindu Undivided Family

| Partnership | Hindu Undivided Family (HUF) |

|---|---|

| A partnership is a type of business organisation in which two or more people come together to carry on a business. | HUF is a type of business organisation in which the family members of a Hindu undivided family collectively own and manage the business. |

| A partnership is governed by the Indian Partnership Act, 1932. | HUF is governed by the Hindu Succession Act, 1956. |

| A partnership deed, which outlines the partnership’s terms and conditions, including the profit-sharing ratio, each partner’s capital commitment, their respective roles and responsibilities, etc., creates a partnership. | HUF is created by the operation of law, that is, by the birth of a male child in a Hindu undivided family. |

| Each partner’s responsibility in a partnership is uncapped. This indicates that the partners are liable for the debts and obligations of the partnership jointly and severally. | In an HUF, the liability of the members is limited to the extent of their share in the HUF property |

| A partnership can have a maximum of 20 partners in a general partnership and 50 partners in a banking business. | There is no upper limit for the total number of members in the HUF. |

| A partnership is a separate legal entity | HUF is not a separate legal entity |

| In a partnership, the partners divide the company’s gains and losses according to the proportion specified in the partnership deed. | In a HUF, members split the business’s gains and losses proportionately to their ownership stakes in the HUF’s assets. |

| Partnership firm is dissolved based on the mutual consent from every partner or through legal operations | An HUF can be dissolved by the members of the HUF or by operation of law. |

| In a partnership, the partners have the right to manage the business and make decisions jointly. | In an HUF, the karta or head of the family has the right to manage the business and make decisions on behalf of the family. |

Partnership Vs. Co-ownership

| Partnership | Co-ownership |

|---|---|

| Formation | Formed by agreement between two or more partners |

| Ownership | Partners own the business and share profits, losses, and liabilities. |

| Management | The business is managed by the partners jointly |

| Liability | Partners are jointly liable for all the debts and obligations. |

| Transfer of interest. | With the consent of all partners or referring to the terms and conditions provided in the partnership deed. |

| Taxation | The firms are not taxed as separate entities. The partners report their share on their personal tax returns. |

| Termination | Partnerships may be dissolved by agreement, death or incapacity of a partner, bankruptcy, or court order |

Partnership Vs. Association

| Partnership | Association |

|---|---|

| A partnership firm is a business structure where two or more individuals share ownership and responsibility. | On the other hand an Association represents a group of people who come together to attain a common interest. |

| Both the profits and losses are shared equally among the partners | Association members do not typically share profits and losses, and the organisation is run according to its bylaws. |

| Partners stand liable for all the debt accumulated in the business | Association members generally do not have personal liability for the debts of the organisation |

| Partnerships are typically formed for the purpose of conducting business activities. | Associations can be formed for a variety of purposes, such as social, cultural, or charitable. |

| Partnerships are obligated to report their partnership revenue on their tax returns and pay taxes on it. | Associations may be tax-exempt if they meet certain criteria, such as being organised for a charitable or educational purpose. |

| Partnerships may be dissolved by agreement of the partners, death or withdrawal of a partner, or court order. | Associations may be dissolved by agreement of the members, expiration of the organisation’s charter, or court order. |

| Termination | Partnerships may be dissolved by agreement, death or incapacity of a partner, bankruptcy, or court order |

Needs Professional Tax Service? Contact Us

Navigating the complexities of tax laws and regulations can be overwhelming for businesses and individuals alike. Whether you’re looking to optimize your tax planning, ensure compliance, or resolve tax-related issues, our expert team at ACCOTALE ADVISORY PRIVATE LIMITED is here to help.

- Expert Guidance

- Customized Solutions

- Compliance Assurance

- Tax Optimization

- Tax Optimization

FAQ

Partnership Firm

Registration FAQ’s

A Partnership Firm is a business structure where two or more individuals come together to manage and operate a business according to the terms set out in a partnership deed. Each partner contributes to the business and shares in the profits or losses.

No, registering a partnership firm is not legally mandatory. However, registration offers several legal benefits, such as the ability to file suits against partners or third parties in case of disputes and enforce partner rights.

The key benefits of registering a partnership firm include:

- Legal protection for partners

- The ability to enforce rights and resolve disputes in court

- Greater credibility and trust with clients and suppliers

- Ease of converting to another business structure, such as an LLP, in the future

The required documents for registration include:

- Partnership deed

- PAN cards of all partners

- Identity and address proof of all partners (Aadhar Card, Passport, etc.)

- Proof of the business premises (rent agreement or utility bill)

A Partnership Deed is a legal document that outlines the terms and conditions of the partnership, including the roles, responsibilities, and profit-sharing ratio of the partners. It must be signed by all partners to formalize the partnership.

The registration process typically takes 7-10 working days, depending on the speed of documentation submission and approval from the Registrar of Firms.

Yes, a partnership firm can be converted into other business structures like a Limited Liability Partnership (LLP) or a Private Limited Company if needed.

Testimonials

What Our Clients Says

Newsletter

Signup our newsletter to get update information, insight or news