Removal of Director

Removal of Director

The removal of a director is a formal process undertaken by a company to terminate a director’s position before the end of their tenure. This can be initiated by the shareholders or the board of directors in accordance with the Companies Act and the company’s Articles of Association. A director can be removed due to non-compliance, misconduct, absence from board meetings, or failure to fulfill duties. The process typically involves passing a resolution at a general meeting and providing the director with an opportunity to be heard before the removal is finalized.

Remove a company director smoothly and legally within just 10 days.

Removal of Director: Reasons

Non-Compliance with Company Policies:

A director may be removed for failing to adhere to the company’s policies, rules, or regulations.

Misconduct or Fraud:

Involvement in unethical behavior, fraud, or activities that harm the company’s reputation can lead to removal.

Absence from Board Meetings:

If a director consistently misses board meetings without valid reasons, the company may take action to remove them.

Incompetence or Inefficiency:

A director may be removed if they are found to be incapable of fulfilling their duties or if their performance is unsatisfactory.

Conflict of Interest:

When a director’s personal interests conflict with the company’s objectives, it can be grounds for removal.

Disqualification by Law:

Legal disqualification due to bankruptcy, conviction, or other statutory reasons can lead to the immediate removal of a director.

Consequences of Not Filing Form DIR-12

Non-Compliance Penalties:

Failure to file Form DIR-12 within the stipulated 30 days can attract penalties. The company and its officers in default may be liable for fines ranging from INR 50,000 to INR 5,00,000.

Legal Action Against the Company:

The Registrar of Companies (ROC) may initiate legal proceedings against the company for non-compliance with statutory requirements, which can lead to further legal complications.

Director’s Liability:

Even after resignation, if Form DIR-12 is not filed, the director remains listed as active in the company’s records, making them legally accountable for the company’s activities, including any liabilities, until the filing is completed.

Impact on Compliance Status:

Non-filing of Form DIR-12 can affect the company’s overall compliance status, potentially leading to issues in other regulatory filings and impacting the company’s reputation.

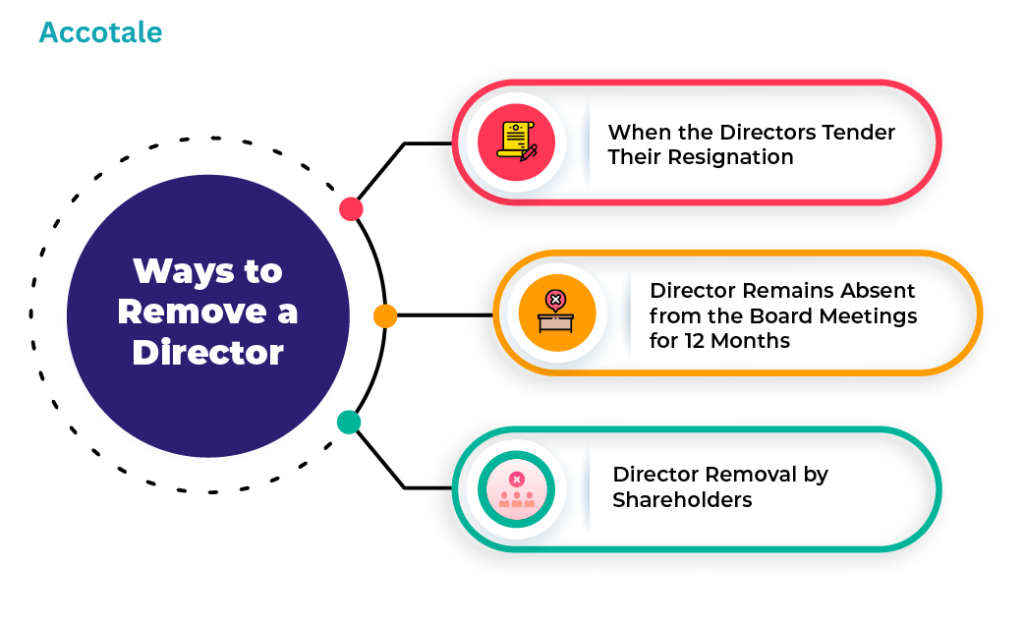

Ways to Remove a Director

Removal of Director – When the Director Tenders Their Resignation: A director may choose to resign voluntarily from the company. In such cases, the director must submit a written resignation letter to the board of directors. The board will then convene a meeting to accept the resignation and pass a resolution approving it. Once the resignation is approved, the company is required to file Form DIR-12 with the Ministry of Corporate Affairs (MCA) within 30 days, officially recording the resignation. The director must also submit Form DIR-11 to inform the MCA of their resignation.

Process for Resignation:

Director submits a resignation letter.

The board of directors holds a meeting to accept the resignation.

Resolution is passed, and Form DIR-12 is filed with the MCA.

Director submits Form DIR-11 to notify their resignation.

Director Remains Absent from Board Meetings for 12 Months: Under Section 167 of the Companies Act, 2013, if a director is absent from all board meetings held during a continuous period of 12 months, without seeking leave of absence, they may be disqualified and automatically vacate their position as a director. This removal does not require shareholder approval. The company must record the absence and file the necessary forms with the MCA to complete the removal.

Process for Absenteeism Removal:

Director misses all board meetings for 12 consecutive months.

Board records the absence and notes the automatic vacation of office.

Form DIR-12 is filed with the MCA to update the company’s records.

Removal of Director by Shareholders: Shareholders have the right to remove a director before the expiration of their tenure by passing an ordinary resolution at a general meeting. This can be done in accordance with Section 169 of the Companies Act, 2013. The company must issue a special notice of the proposed removal to the shareholders, and the director in question must be given an opportunity to present their case before the resolution is passed. Once approved, the company must file Form DIR-12 with the MCA to complete the removal process.

Process for Shareholder-Initiated Removal:

A special notice is issued to shareholders regarding the proposed removal.

General meeting is convened, and the director is given an opportunity to defend themselves.

Shareholders vote on the removal, and if passed, the director is removed.

Form DIR-12 is filed with the MCA to finalize the removal.

Documents Required for Director Removal

Notice of Board Meeting:

A formal notice to all directors about the meeting where the removal will be discussed.

Resignation Letter (if applicable):

If the director is resigning voluntarily, their resignation letter is required.

Board Resolution:

A certified copy of the board resolution approving the removal or acceptance of the resignation of the director.

Special Notice (for Shareholder Removal):

A special notice issued to shareholders for a general meeting to remove the director, along with the agenda.

Minutes of the General Meeting:

A copy of the minutes of the general meeting where the resolution for removal was passed by shareholders.

Form DIR-11 (if resignation):

Filed by the resigning director with the MCA, notifying them of their resignation.

Form DIR-12:

Filed by the company with the Registrar of Companies (ROC) within 30 days to officially record the removal or resignation of the director.

Letter of Representation (if applicable):

If the director was removed through a shareholders’ resolution, any letter from the director defending their case should be included.

Eligibility Criteria to be a Director

Minimum Age Requirement

The individual must be at least 18 years of age. There is no maximum age limit unless specified by the company’s Articles of Association.

(Director Identification) DIN

The individual must have a valid Director Identification Number (DIN), which is issued by the Ministry of Corporate Affairs (MCA).

Natural Person

Only a natural person (an individual) can be appointed as a director. Corporate entities, partnerships, or other legal persons are not eligible.

Capacity to Contract

The individual must not be of unsound mind or an undischarged insolvent, as per the Companies Act, 2013.

No Criminal Disqualification

The person should not have been convicted of an offense involving moral turpitude or imprisoned for a period of more than 6 months within the last 5 years.

Not Disqualified by Law

The individual should not be disqualified from being appointed as a director under the Companies Act, 2013 or any other law. For instance, directors disqualified for not filing annual returns.

Why Choose Accotale Advisory?

Expert Team:

With a team of highly qualified professionals in accounting, tax, and financial advisory, Accotale delivers top-notch services tailored to your business needs.

Comprehensive Solutions:

From tax consultancy to structured finance, we offer a wide range of financial services under one roof, ensuring seamless and efficient support for your business.

Client-Centric Approach:

We focus on building long-term relationships by providing personalized solutions and proactive advice that drive growth and compliance.

Proven Track Record:

Our extensive experience in the industry, combined with our commitment to excellence, makes us a trusted partner for businesses across various sectors.

Testimonials

What Our Clients Says