Changes to LLP Agreement

Change Your Objectives of Business

The LLP Agreement governs the rights, duties, and obligations of the partners within a Limited Liability Partnership (LLP). Any modification to this agreement, whether to reflect changes in business operations, partner roles, or profit-sharing ratios, requires formal updates. These changes must be agreed upon by all partners and filed with the Registrar of Companies (RoC) within 30 days of the amendment.

Key reasons for changing an LLP Agreement include adding or removing partners, altering capital contributions, or restructuring the business model. Ensuring that changes are legally documented is crucial for maintaining compliance and protecting the interests of all partners involved.

- Changes in Profit-Sharing Ratios: Partners may agree to revise how profits and losses are distributed, requiring an update to the agreement.

- Addition or Removal of Partners: When new partners join or existing partners exit, the LLP Agreement must be updated to reflect these changes.

Common Reasons for Making Changes in an LLP Agreement

Addition or Removal of Partners

New partners may join, or existing partners may exit the LLP due to expansion, resignation, or retirement, necessitating changes to the agreement.

Change in Capital Structure

Adjustments to the capital contributions of partners or any financial restructuring require an update to the LLP agreement.

Change in Profit and Loss Sharing Ratio

Partners may agree to redistribute profits or losses differently, which must be reflected in the agreement.

Change in Business Activities

Expanding or altering the business scope or objectives often leads to the need for updating the LLP agreement to ensure alignment with the current operations.

Changes in Partner Roles and Responsibilities

If there’s a shift in the roles or duties of the partners, such as new designations or responsibilities, this must be formally documented.

Change in Registered Office Address

Moving the registered office to a new location requires changes to the agreement to reflect the updated address.

The Most Common Changes That Occur in an LLP

Addition or Removal of Partners

Partners may join or leave the LLP due to various reasons like expansion, resignation, or retirement. Any change in partnership must be updated in the LLP agreement.

Change in Capital Contribution

The amount of capital each partner contributes may change over time, requiring an update to the agreement to reflect the new financial arrangement.

Alteration of Profit-Sharing Ratio

If partners decide to redistribute the profits differently, the LLP agreement must be amended to detail the new profit-sharing ratios.

Change in Business Activities or Objectives

Expanding or shifting the nature of the business might necessitate changes in the LLP agreement, ensuring that the document aligns with the company’s current operations.

List of Documents Required to Change an LLP Agreement

To modify an LLP agreement, the following documents are required:-

- Original LLP Agreement

- Supplementary/Amended LLP Agreement

- Additional deed

- Form LLP-3

- Partner's KYC Documents

- Proof of Address

- Digital Signature Certificate (DSC)

- Payment Receipts

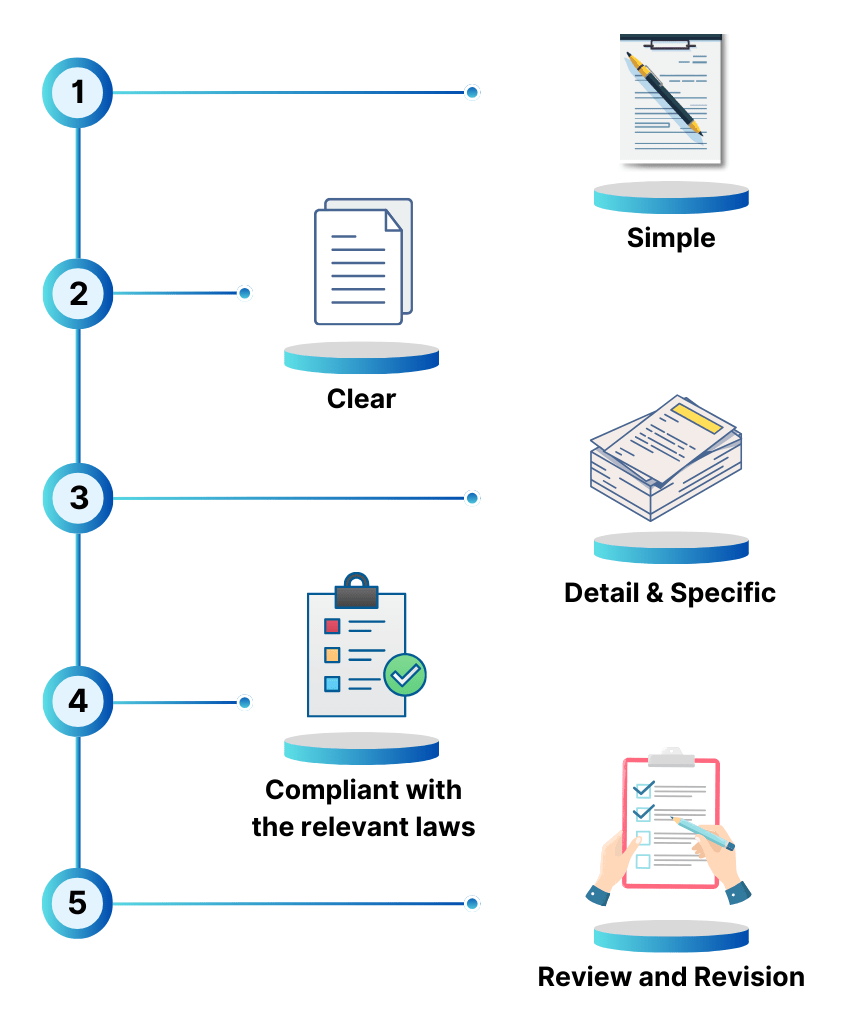

Process to Make Changes in LLP Agreement

Decision & Drafting the Changes:

Partners discuss and decide on the necessary changes (e.g., addition of partners, change in capital structure). A supplementary or amended LLP agreement is drafted reflecting these changes.

Consent from All Partners:

All partners must provide their consent to the proposed changes. A resolution or agreement is prepared, signed by all partners, acknowledging the modifications.

Filing Form LLP-3 with RoC:

The designated partners must file Form LLP-3 online with the Registrar of Companies (RoC) through the MCA portal. This form provides details of the amendments in the LLP agreement.

Submission of Required Documents:

Upload the required documents, including the original LLP agreement, the amended agreement, and the resolution of partners’ consent along with Form LLP-3.

Payment of Government Fees:

Pay the applicable filing fees based on the changes made in the LLP agreement. The fees vary depending on the capital contribution and nature of the changes.

Verification & Approval by RoC:

Once submitted, the RoC reviews the application. If the form and documents are in order, the RoC approves the amendments, and the changes are officially recorded.

Receive Acknowledgment:

After approval, the updated LLP agreement and Form LLP-3 status are acknowledged, completing the change process.

Why Choose Accotale?

Comprehensive Expertise

We provide a full suite of accounting, tax consultancy, and advisory services tailored to meet your business needs.

Client-Centered Approach

At Accotale, we prioritize personalized service, ensuring that our solutions are aligned with your unique financial goals.

Experienced Professionals

Our team of seasoned experts brings years of industry experience, ensuring accuracy and compliance in every service we offer.

Efficiency and Transparency

We are committed to providing quick, transparent, and hassle-free processes, making your financial journey smooth and stress-free.

Who Cannot Be Appointed as a Designated Partner in an LLP?

Certain individuals are legally disqualified from being appointed as designated partners in a Limited Liability Partnership (LLP) under the LLP Act, 2008. These disqualifications ensure that only eligible and compliant individuals take on the role.

FAQ

Frequently Asked Questions

on Change in LLP Agreement

An LLP Agreement is a legal document outlining the rights, duties, and responsibilities of the partners in a Limited Liability Partnership (LLP). It also governs the internal operations of the LLP.

An LLP Agreement can be changed at any time, usually when there is a need to alter clauses related to profit sharing, the admission or removal of partners, the change in capital contributions, or other operational changes.

Changes to the LLP Agreement must be filed with the Registrar of Companies (RoC) through the MCA portal by submitting Form LLP-3, along with the required documents such as the original agreement and the amended agreement.

Form LLP-3 is the form used to notify the Registrar of Companies about changes made in the LLP Agreement. It must be filed within 30 days from the date of the change.

Yes, the government charges a filing fee for the submission of Form LLP-3, which depends on the capital contribution and the nature of the changes.

Testimonials

What Our Clients Says